In the evolving landscape of 2026, the structural transformation of enterprise financial operations is moving beyond simple automation toward a fundamental reconceptualization of the firm’s epistemic architecture. We are witnessing the birth of Dark Finance: an institutional model where autonomous logic systems execute the procedural labor of the firm while human authority remains the singular anchor for professional and legal accountability.

This evolution is driven by two converging technological shifts: the Headless ERP and the Conversational ERP interface.

I. The Problem: Accountability Dissolution in the Age of Complexity

Contemporary financial enterprises exist within a paradox: operational complexity has exceeded human cognitive capacity, yet the legal architecture remains predicated on individual human accountability. Traditional automation has treated technology as a mere tool, but as systems gain the autonomy to initiate and conclude complex sequences without supervision, the fiduciary relationship that constitutes a firm’s legitimacy is at risk.

This results in the accountability dissolution problem. If an autonomous system executes a financial operation that produces harm or error, the traditional link between the executor of an action and the bearer of liability is severed. To resolve this, we must restructure the organization into a stratified model that clearly separates mechanical execution from professional judgment.

II. The Architecture: Headless ERP and Stratified Labor

The foundation of Dark Finance is the Headless ERP. Unlike legacy systems that bundle data logic with a rigid user interface, a headless system decouples the “body” (data, tax rules, general ledger) from the “head” (how we interact with it). This body is accessed exclusively through programmatic interfaces (APIs), allowing for perfect data fidelity and operational scalability.

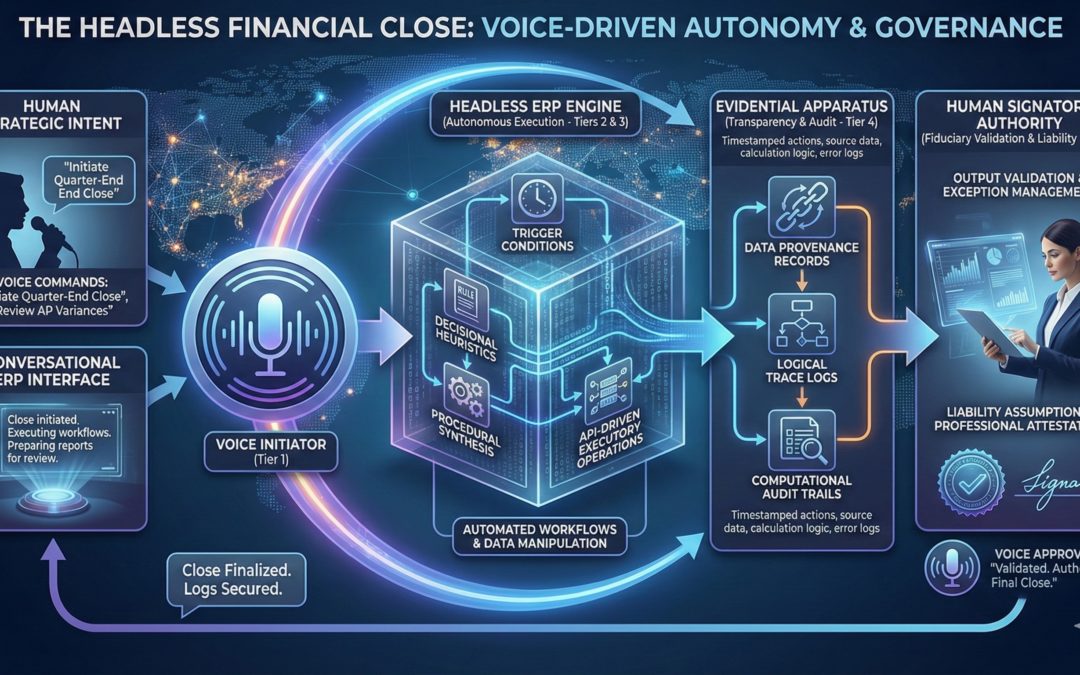

To govern this headless body, we apply a four-tier model of organizational labor:

Tier One: Strategic Intentionality (Human Initiator): The determination of organizational objectives—such as setting financial targets or risk appetites—remains irreducibly human because it involves value judgments that data alone cannot provide.

Tier Two: Procedural Synthesis (Autonomous AI): High-level directives are translated into executable operations by the system, mapping rules and regulatory requirements to specific actions.

Tier Three: Executory Operations (Headless Engine): The mechanical manipulation of data, performed programmatically via APIs to eliminate transcription errors.

Tier Four: Fiduciary Validation (Human Signatory): The application of professional judgment to review outputs and accept legal responsibility for their accuracy.

III. The Driver: Conversational ERP and Voice-Driven Autonomy

If the Headless ERP is the body, the Conversational ERP is the voice. This interface allows the Human Initiator to drive the financial close using natural language. This is not merely a “chat box”; it is a command-and-control system where voice triggers the autonomous logic of the firm.

A voice-driven “Financial Close” might look like this:

Triggering: The Initiator says, “Initiate the December period close for all European subsidiaries. Flag any intercompany variances exceeding 2%.”

Asynchronous Orchestration: The system initiates background computational jobs, managing informational flows and data transformations concurrently.

Deterministic Computation: The system applies scripted logic (e.g., Python or R) to ensure mathematical transformations are perfectly reproducible and transparent.

IV. The Anchor: The Signatory Authority and the Evidential Apparatus

The transition to autonomous operations requires a new professional role: the Signatory Authority. This individual does not re-perform the work; instead, they serve as the quality assurance mechanism for the automated ecosystem.

To allow the Signatory to accept liability for work they did not personally execute, the system must generate a comprehensive Evidential Apparatus:

Data Provenance Records: Precise identifiers showing which source data (database record IDs, timestamps) were used.

Logical Trace Logs: Documentation of which specific rules and heuristics were triggered during the process.

Computational Audit Trails: Logs of mathematical transformations and intermediate results for independent verification.

Temporal Metadata: A chronological record of system activity to support regulatory audits.

By reviewing this apparatus, the Signatory provides a “reality check” that autonomous systems lack, catching edge cases where a process might be mathematically correct but contextually wrong.

V. Conclusion: Professional Elevation

Implementing a Dark Finance architecture is not about reducing headcount; it is about Professional Elevation. We are moving the finance professional away from the mechanical “detached rule-following” of Tiers 2 and 3 and toward the high-value strategic oversight of Tiers 1 and 4.

In this hybrid institutional form, the organization becomes a continuously learning system. We leverage machine capabilities where they are superior—precision, scale, and speed—while preserving human judgment where it is essential: at the points of initiation and accountability.

The future of finance is a system that can be spoken to, a logic that can be trusted, and a human who stands behind it all.