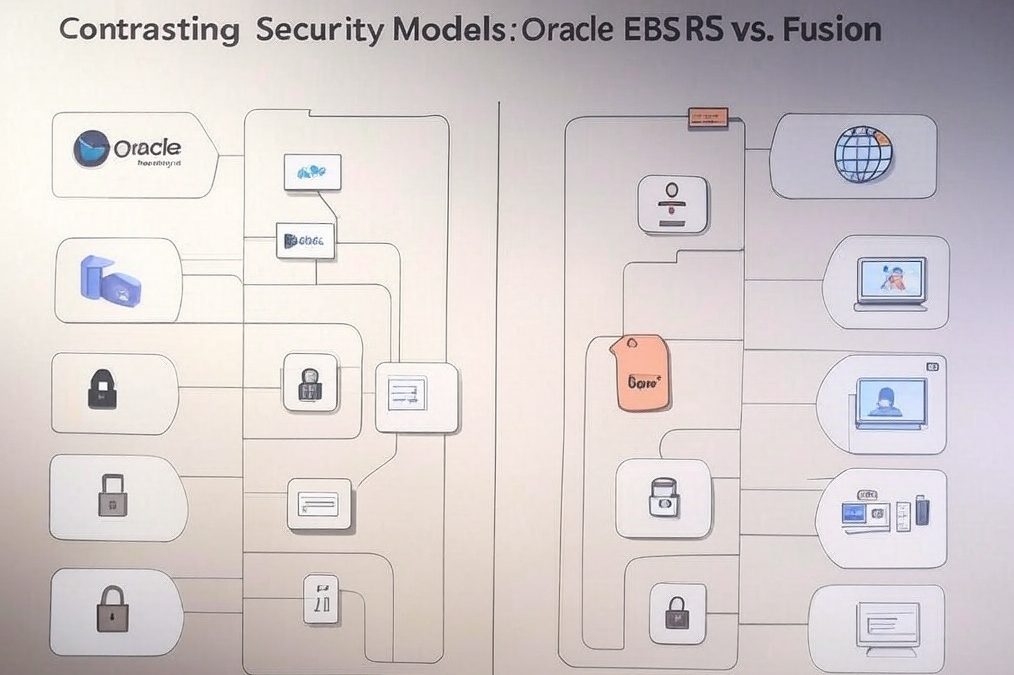

Equivalent Security Setup in Oracle Fusion Applications for EBS Global Security Profile

This document explains how to achieve data isolation in Oracle Fusion Applications, equivalent to creating a Global Security Profile and MOAC Security Profile in Oracle E-Business Suite (EBS) R12.2 for a new Business Group (e.g., “MyCompany_BG” or Business Group A)...

Ubuntu 24 on AWS Instance VNC NGINX YT-DLP

Setting Up Ubuntu 24.04 Desktop on AWS EC2 with VNC Introduction This guide walks you through setting up a graphical Ubuntu 24.04 desktop environment on an AWS EC2 instance, accessible remotely via VNC. We’ll install a lightweight desktop (XFCE), TightVNC...

Guide to Leveraging LinkedIn and Dice Job Scrapers

Overview This guide covers two Python scripts designed to scrape job listings from LinkedIn and Dice based on specific search criteria. Both scripts use Selenium for web scraping and store the data in a MongoDB database. The LinkedIn scraper targets Oracle-related...