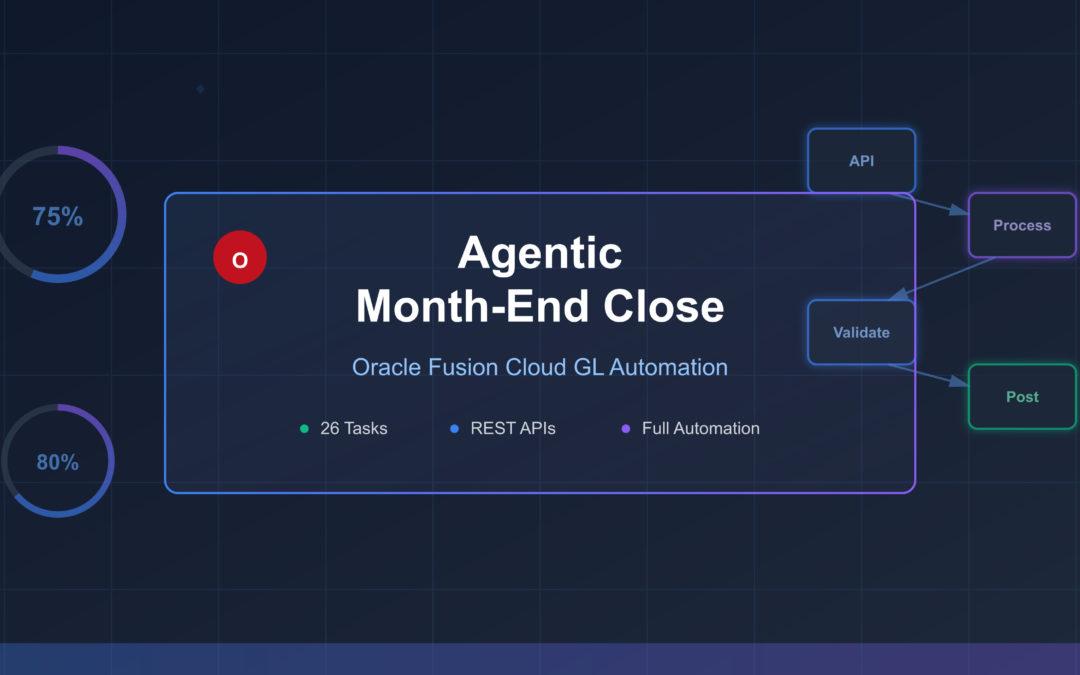

The promise of AI agents in enterprise finance is moving from theory to practice. But can you really build an autonomous agent that handles your Oracle Fusion Cloud GL month-end close? Let’s examine what’s possible today, what the APIs support, and where the gaps remain.

The Vision: An Agent That Closes Your Books

Imagine an AI agent that wakes up on the first business day after month-end and systematically executes all 26 tasks required to close your general ledger. It checks prerequisites, submits jobs, monitors progress, handles exceptions, and escalates only when human judgment is truly needed. No more midnight close sessions. No more manual checklists.

Sounds compelling. But the devil is in the implementation details.

Understanding the Business Objects

Before we can build an agentic close process, we need to understand what objects the agent will manipulate. Oracle Fusion Cloud GL is built on several core entities:

Ledger Objects form the foundation. Your primary ledger is the official book of record, with secondary ledgers providing alternate accounting views. Ledger sets enable consolidated reporting. Most importantly for close automation, accounting periods have distinct statuses that control what operations are allowed.

Journal Objects represent the actual accounting entries. Journal headers contain batch-level metadata, while journal lines capture individual debits and credits. Each journal has a source system, category classification, and status that progresses from draft to posted. An agent needs to track all of these.

Subledger Objects feed the general ledger. Accounting events from Payables, Receivables, Fixed Assets, and Projects flow through the Create Accounting process to generate subledger journal entries before hitting GL. The agent must orchestrate this upstream processing before touching GL itself.

Close Process Objects include period status indicators, the close monitor hierarchy, and exception reports that identify unaccounted or unposted transactions. These objects tell the agent what state the ledger is in and what problems need resolution.

Reconciliation Objects like GL balances, trial balance totals, and account combinations enable the agent to validate that everything balances before declaring the close complete.

API Capabilities: What Works Well

The good news is that Oracle Fusion Cloud provides robust REST API support for many critical close operations.

Journal Import through the erpintegrations endpoint is well-designed for programmatic access. An agent can upload CSV or ZIP files containing journal data, submit the import job, and monitor its status. The file-based data import pattern works well for agents that can generate properly formatted files and handle asynchronous processing.

Query and Read Operations are straightforward. Standard REST GET calls retrieve ledger details, period information, journal status, and account balances. An agent can easily check prerequisites and validate state before taking action.

ESS Job Submission enables the agent to trigger heavyweight processes like Create Accounting and Post Journals. While these operations are asynchronous and batch-oriented, the pattern of submitting a job and polling for completion maps well to agent workflows. The agent submits the request, monitors the status endpoint, and processes the results when complete.

Accounting Hub Integration provides well-documented APIs for importing data from external systems and applying accounting rules. For organizations using Accounting Hub as their subledger integration layer, this provides additional automation opportunities.

The API Gaps

Despite strong API coverage, several limitations constrain full automation.

Period Open and Close Operations can be executed programmatically through ESS jobs or the UI’s “Manage Accounting Periods” screen. While there isn’t a dedicated REST API endpoint for period status changes, agents can trigger period open/close operations by submitting the appropriate ESS scheduled processes or by updating period status through the Manage Accounting Periods task. This makes period close automation fully achievable within the agentic architecture.

Create Accounting from subledgers is job-based rather than transactional. An agent can submit the ESS job via REST API, but must then poll asynchronously for completion. There’s no real-time, synchronous create accounting operation. The agent needs to implement proper polling logic with timeouts and retry mechanisms.

Posting Journals follows the same batch pattern. There’s no API to post a single journal on demand. Instead, the agent submits a “Post Journal Entries” ESS job, waits for completion, and handles any posting errors that emerge.

Exception Handling relies heavily on report parsing. When Create Accounting fails for some transactions or journals fail to post, the details appear in execution reports that the agent must download and parse. Unlike modern APIs that return structured error objects, the agent needs to interpret semi-structured report output to understand what went wrong.

An Agentic Architecture That Works

Given these capabilities and constraints, here’s how an agent could orchestrate a realistic month-end close:

The agent starts by querying period status to confirm it’s working with the correct accounting period. It checks subledger accounting status to ensure upstream systems have processed their month-end transactions.

Next, it submits Create Accounting jobs for each subledger module, polling job status until completion. When jobs finish, it downloads exception reports, parses them to identify unaccounted transactions, and either attempts automatic resolution for simple errors or escalates complex issues to accounting staff.

For manual journal entries needed at month-end, the agent imports journals via the file-based data import mechanism. It uploads properly formatted files, submits the import job, monitors completion, and validates that journals loaded successfully.

After all journals are in the system, the agent submits the Post Journals job. It monitors posting status, checks for posting errors, and validates that critical journals posted successfully. If posting fails, it analyzes the errors and either corrects simple issues or escalates to users.

The agent runs any needed revaluation processes for foreign currency balances, generates allocation journals for cost distributions, and submits a final posting job to ensure everything is accounted for.

It queries the trial balance to validate that debits equal credits and performs reconciliation checks against expected balances. For organizations with specific close validation rules, the agent can incorporate those checks here.

Finally, the agent reaches the one step it likely can’t automate fully: closing the period. This may require human confirmation or integration with UI automation to trigger the period status change.

Key Implementation Patterns

Several technical patterns enable robust agentic automation:

For file uploads, the agent uses Base64 encoding to package FBDI files and submits them to the erpintegrations endpoint with appropriate parameters for ledger ID, source system, and journal group.

Job monitoring follows a three-step pattern: load content to Oracle UCM (Universal Content Management), submit the ESS job referencing that content, and poll the job status endpoint until completion.

All major operations are asynchronous, so the agent needs proper async handling. It can’t assume immediate completion but must implement polling loops with exponential backoff and timeout logic.

Exception parsing requires the agent to download report output files, parse semi-structured content, extract error codes and descriptions, and route issues to appropriate handlers or human reviewers.

What Makes This “Agentic”?

An agentic month-end close demonstrates several key characteristics:

The agent orchestrates the full sequence autonomously, following a defined workflow but adapting to conditions it encounters. If Create Accounting fails for AP, it doesn’t blindly proceed to posting, but instead handles that issue first.

It monitors job status continuously and implements intelligent retry logic. If a job fails due to a transient error, the agent retries automatically. If the error is persistent, it escalates.

It parses exceptions and routes them appropriately. Simple errors like missing account combinations might trigger automatic correction. Complex exceptions requiring judgment get escalated to accounting staff with full context.

It validates prerequisites at each step. Before posting journals, it confirms that Create Accounting completed successfully. Before closing the period, it validates that all required journals posted and balances reconcile.

Current Limitations

Despite these capabilities, several limitations require careful handling:

Complex exception resolution often requires human judgment. When Create Accounting fails because a new account combination is invalid against the chart of accounts structure, determining the correct account requires understanding the business context that agents don’t possess.

Cross-ledger reconciliation can require custom logic that varies by organization. While the agent can query balances from multiple ledgers, validating that they reconcile according to company-specific rules may need custom implementation.

The Realistic Automation Target

Given current API capabilities, you can realistically automate 90-95% of month-end close tasks through an agentic architecture. The remaining 5-10% involves complex exception handling that benefits from human oversight.

The recommended approach uses the erpintegrations REST API for all journal imports and ESS job submissions, builds robust exception parsing logic to interpret job output files, implements a state machine to track close progress across all tasks, and integrates with approval workflows for journals requiring sign-off. Reserve the period close trigger as a final human checkpoint where someone confirms the agent’s work before making the period permanent.

Moving Forward

Building an agentic month-end close in Oracle Fusion Cloud is possible today with the existing REST API framework. The APIs support the critical operations, the architecture patterns are well-understood, and the missing pieces can be bridged with human checkpoints.

The key is starting with clear objectives. What percentage of your close do you want automated? Which tasks are most time-consuming and repetitive? Where does human judgment add the most value?

Begin by automating the high-volume, low-complexity tasks: submitting Create Accounting, importing standard journals, posting batches, running standard reports. As the agent proves reliable, gradually expand its scope into more complex territory.

The agentic month-end close isn’t about eliminating accountants. It’s about letting them focus on analysis, judgment, and value-added work while the agent handles the mechanical orchestration of close processes. That’s a future worth building toward.