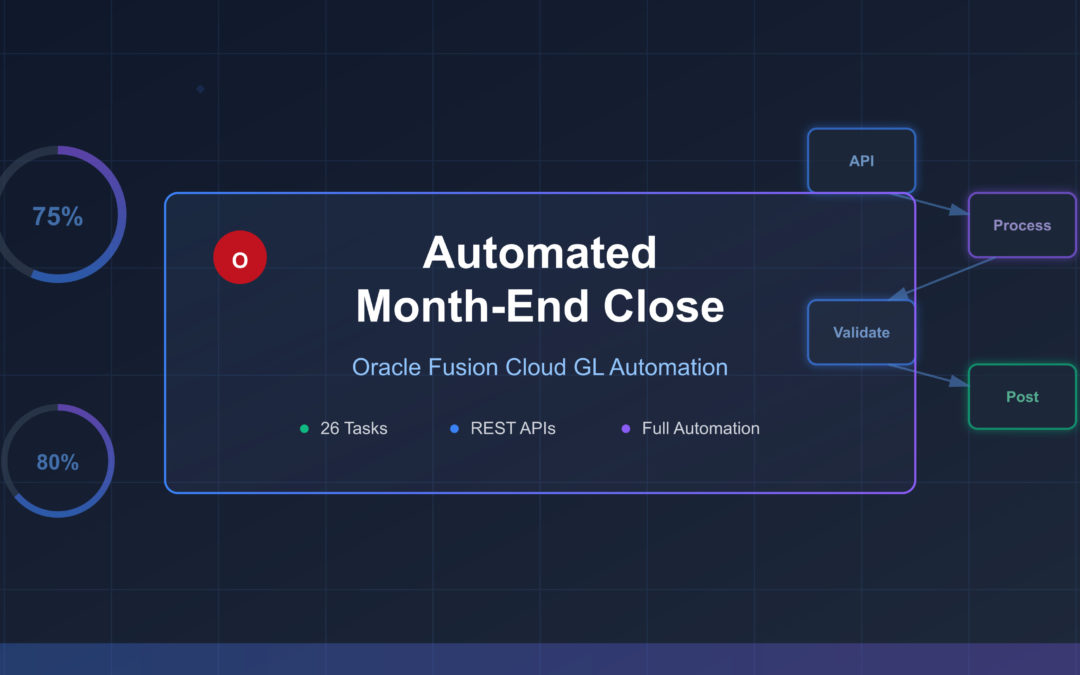

A Complete Guide to Oracle Fusion Cloud GL Automation

The month-end close process has long been the bane of finance teams everywhere. Late nights, spreadsheet gymnastics, and the constant pressure to close faster while maintaining accuracy—sound familiar? If you’re running Oracle Fusion Cloud, you have powerful automation capabilities at your fingertips that can transform this monthly marathon into a streamlined, largely hands-off process.

In this comprehensive guide, I’ll walk through all 26 typical GL close tasks and show you exactly how to automate each one using Oracle Fusion Cloud’s APIs and native automation features. Whether you’re a finance leader looking to reduce close time or a technical architect designing integration solutions, this guide will give you the blueprint for a truly automated close.

The Promise of Close Automation

Before we dive into the technical details, let’s set the stage. A typical GL close involves 26 distinct tasks ranging from recording accruals to posting intercompany eliminations to finally closing the period. Traditionally, each of these tasks requires human intervention—someone needs to calculate amounts, prepare journal entries, review balances, and ultimately post transactions.

Oracle Fusion Cloud changes this paradigm. Through a combination of native automation features, REST APIs, and integration capabilities, you can automate the majority of these tasks. The result? Faster closes, fewer errors, better compliance, and finance teams that can focus on analysis rather than data entry.

Let’s break down each task category and explore the automation possibilities.

Category 1: Native Oracle Automation (Set It and Forget It)

Some tasks can be fully automated using Oracle Fusion’s built-in capabilities with minimal custom development. These are your quick wins.

Task 26: Close the Period in the GL System

This is the final step in your close process, and it’s completely automatable.

The Solution: Oracle provides a dedicated REST API for period management. You can programmatically check period status, validate that all prerequisite tasks are complete, and close the period—all without human intervention.

Technical Implementation:

API Endpoint: /fscmRestApi/resources/11.13.18.05/ledgerPeriods

Method: PATCH

Payload: Update period status to 'CLOSE'You can trigger this via Oracle Integration Cloud (OIC) as the final step in your close orchestration, or schedule it as an Enterprise Scheduler Service (ESS) job that runs after all other close tasks complete. Build in validation checks to ensure all prior tasks have been completed before executing the close.

Best Practice: Implement a pre-close validation dashboard that checks all task completion statuses. Only trigger the period close API call when all dependencies show green.

Task 25: Record Foreign Currency Revaluation Entries

If your organization operates in multiple currencies, revaluation is a critical but tedious month-end task. Oracle Fusion fully automates this.

The Solution: The General Ledger Revaluation Program is a native ESS job that automatically calculates unrealized gains and losses based on period-end exchange rates and posts the appropriate journal entries.

Technical Implementation:

Process: General Ledger Revaluation

API Trigger: ESS Job Submission API

Endpoint: /fscmRestApi/resources/11.13.18.05/erpintegrations

Method: POST (submit job)The system pulls current exchange rates from your defined rate sources (Oracle’s daily rates, manual uploads, or third-party feeds), compares them to original transaction rates, and generates revaluation journals automatically. You can schedule this to run on the last business day of each period.

Configuration Keys:

- Define revaluation rules per ledger

- Specify which accounts require revaluation

- Set up exchange rate sources and priorities

- Configure posting options (summary vs. detail)

Automation Workflow:

- ESS job scheduled for last day of period (or triggered via API)

- System retrieves period-end exchange rates

- Calculates unrealized gains/losses on open foreign currency balances

- Generates and posts revaluation journal entries

- Updates balances in reporting currency

Category 2: Recurring Journal Formula Automation

Several standard accruals and adjustments follow predictable patterns and can be automated using Oracle’s recurring journal functionality combined with formula-based calculations.

Tasks 1, 4, 5, 6, 7, 17: Pattern-Based Entries

These tasks share a common characteristic: they follow consistent rules that can be expressed as formulas or percentages.

Tasks Covered:

- Task 1: Record reversing entries for prior-period temporary accruals

- Task 4: Record amortization of prepaid items

- Task 5: Record right-of-use asset amortization (lease accounting)

- Task 6: Accrue interest

- Task 7: Record earned portion of deferred revenue

- Task 17: Record allocation entries

The Solution: Oracle’s AutoAccounting Rules combined with Recurring Journal Formulas provide a powerful automation engine. You can define journals that automatically calculate amounts based on account balances, fixed formulas, or percentage allocations.

Technical Implementation:

Setup: Configure formula-based recurring journals in GL

API: Journal Entry REST API

Endpoint: /fscmRestApi/resources/11.13.18.05/journalBatches

Method: POST

Process: "Create Recurring Journals" (ESS job)Example: Prepaid Amortization (Task 4)

Let’s say you have a $12,000 annual insurance policy paid on January 1. You need to amortize $1,000 monthly.

Configuration approach:

- Create a recurring journal template

- Define formula:

Balance(Prepaid Insurance) * 0.0833(1/12) - Set debit/credit accounts

- Schedule monthly execution

- Enable auto-posting

The system will query the prepaid insurance balance each month, calculate the amortization amount, and post the entry automatically.

Example: Lease Amortization (Task 5)

Oracle Fusion includes native lease accounting functionality (FASB ASC 842 / IFRS 16 compliant). Right-of-use asset amortization can be fully automated:

- Lease contracts are entered in Oracle Assets or Lease Management

- Amortization schedules are automatically generated

- Monthly amortization entries post to GL automatically via subledger accounting

- No manual calculation required

Example: Revenue Recognition (Task 7)

For deferred revenue earned over time:

- Configure revenue recognition rules based on performance obligations

- Set up recurring journal to recognize revenue based on percentage of completion or time elapsed

- Formula references deferred revenue balance and recognition period

- Journal automatically posts each month

API Automation Pattern:

While these can run as scheduled ESS jobs, you can also trigger them via API for more granular control:

json

POST /fscmRestApi/resources/11.13.18.05/journalBatches

{

"BatchName": "Monthly Recurring - Prepaid Amortization",

"BatchDescription": "Automated prepaid expense amortization",

"LedgerName": "Corporate Ledger",

"AccountingPeriod": "Jan-26",

"JournalEntries": [

{

"JournalName": "PREPAID_AMORT_JAN26",

"JournalLines": [

{

"LineNumber": 1,

"AccountCombination": "01-5020-000-0000",

"DebitAmount": "{{CALCULATED_AMOUNT}}",

"Description": "Prepaid amortization"

},

{

"LineNumber": 2,

"AccountCombination": "01-1450-000-0000",

"CreditAmount": "{{CALCULATED_AMOUNT}}",

"Description": "Prepaid amortization"

}

]

}

],

"PostingOption": "POST"

}Best Practice: Create a library of recurring journal templates during implementation. Document the business rules behind each formula. Schedule these to run early in the close cycle so downstream tasks can rely on updated balances.

Category 3: Source System Integration Automation

The majority of accruals and adjustments require data from upstream systems—AR, Payroll, HCM, Tax, Treasury. These tasks are automatable, but require integration development.

Tasks 2, 3, 8, 9, 10, 11, 12, 13, 14, 15, 16, 18, 19: Data-Driven Accruals

Tasks Covered:

- Task 2: Record allowance for doubtful accounts adjustment

- Task 3: Record inventory reserve adjustments

- Task 8: Accrue reserves

- Task 9: Accrue taxes

- Task 10: Accrue deferred tax adjustments

- Task 11: Accrue bonus and commission

- Task 12: Accrue paid time off and leave

- Task 13: Accrue benefits

- Task 14: Record stock-based compensation

- Task 15: Accrue severance (if applicable)

- Task 16: Record bad debt adjustment

- Task 18: Accrue interest and dividend income

- Task 19: Record unrealized gains/losses on investments

The Common Pattern:

All these tasks follow a similar automation pattern:

- Source system calculates the accrual amount based on business rules

- Integration layer formats the data as a journal entry

- API posts the journal to GL

- Optional: Journal auto-posts or routes through approval workflow

The Core API:

The Journal Entry REST API is your workhorse for these integrations.

Endpoint: /fscmRestApi/resources/11.13.18.05/journalBatches

Method: POST

Authentication: OAuth 2.0 or Basic Auth

Content-Type: application/jsonDeep Dive: Task 2 and 16 (Allowance for Doubtful Accounts and Bad Debt)

These AR-related adjustments can be automated through Oracle Receivables integration.

Automation Approach:

Option 1: Subledger Accounting (Preferred) Oracle Receivables automatically generates accounting entries based on transaction types. Configure Subledger Accounting rules to post bad debt write-offs and allowance adjustments directly.

Configuration:

- Define accounting rules for bad debt write-offs

- Set up aging buckets and reserve percentages

- Configure automatic write-off thresholds

- Subledger Accounting Engine posts to GL automatically

Option 2: Custom Calculation + API Posting For more complex reserve methodologies:

- Extract AR aging data via Receivables REST API

- Apply your reserve calculation logic (external system or Oracle Analytics)

- Calculate required adjustment to allowance account

- POST journal entry via Journal API

json

POST /fscmRestApi/resources/11.13.18.05/journalBatches

{

"BatchName": "Bad Debt Reserve - Jan 2026",

"LedgerName": "Corporate Ledger",

"AccountingPeriod": "Jan-26",

"JournalEntries": [

{

"JournalName": "BD_RESERVE_JAN26",

"JournalSource": "Receivables",

"JournalCategory": "Adjustments",

"JournalLines": [

{

"LineNumber": 1,

"AccountCombination": "01-6500-000-0000",

"DebitAmount": 15000,

"Description": "Bad debt expense - Jan aging"

},

{

"LineNumber": 2,

"AccountCombination": "01-1210-000-0000",

"CreditAmount": 15000,

"Description": "Allowance for doubtful accounts"

}

]

}

],

"PostingOption": "POST"

}Deep Dive: Tasks 11, 12, 13 (Payroll Accruals)

Bonus, PTO, and benefit accruals are prime automation candidates because Oracle HCM already tracks this data.

Automation Approach:

Oracle HCM Cloud includes robust compensation and absence management modules. The key is extracting accrual data and posting to GL.

Implementation Pattern:

- HCM Calculates Accruals:

- Bonus accruals based on performance ratings and accrual schedules

- PTO accruals based on service time and accrual rules

- Benefit accruals based on enrollment and employer contribution formulas

- HCM Extract to GL:

- Use HCM Data Loader or HCM Extract to pull accrual data

- Transform to GL journal format

- Post via Journal Entry API

Sample Integration Flow:

HCM Cloud → HCM Extract (OTBI/BI Publisher) →

OIC Integration → Transform to Journal Format →

GL Journal API → Auto-PostAlternative: Costing Integration:

If you’re using Oracle HCM Costing, the system can automatically create labor distribution and accrual journals that flow to GL via Subledger Accounting. This is the most seamless approach but requires proper HCM Costing setup.

Journal API Payload Example:

json

{

"BatchName": "Payroll Accruals - January 2026",

"JournalEntries": [

{

"JournalName": "BONUS_ACCRUAL_JAN26",

"JournalLines": [

{

"AccountCombination": "01-6100-100-0000",

"DebitAmount": 50000,

"Description": "Bonus accrual - Sales dept"

},

{

"AccountCombination": "01-2110-000-0000",

"CreditAmount": 50000,

"Description": "Accrued bonus liability"

}

]

},

{

"JournalName": "PTO_ACCRUAL_JAN26",

"JournalLines": [

{

"AccountCombination": "01-6150-000-0000",

"DebitAmount": 25000,

"Description": "PTO expense"

},

{

"AccountCombination": "01-2120-000-0000",

"CreditAmount": 25000,

"Description": "Accrued PTO liability"

}

]

}

]

}Deep Dive: Task 14 (Stock-Based Compensation)

Stock compensation accounting can be complex, but Oracle provides multiple automation paths.

Automation Approach:

Option 1: Oracle HCM Compensation (if you have Oracle equity management) Configure stock grant types, vesting schedules, and accounting rules. The system calculates expense and posts to GL automatically.

Option 2: External Equity System Integration Most companies use specialized equity management systems (E*TRADE, Shareworks, Carta, etc.).

Integration pattern:

- Export compensation expense data from equity system (monthly)

- Use File-Based Data Import (FBDI) template for GL journal import

- Alternatively, transform to JSON and POST via Journal API

- Include grant details in journal line descriptions for audit trail

FBDI Approach: Oracle provides pre-built Excel templates for journal import. Your equity system can populate this template with expense amounts by department, grant type, and vesting period. Upload to Oracle WebCenter Content (UCM), and the system automatically creates and posts journals.

API Approach (more flexible): Extract expense data from equity system, transform to journal format, POST to API with detailed line-level attributes (project, department, grant ID).

Deep Dive: Tasks 9, 10 (Tax Accruals)

Tax accounting automation depends on your tax calculation methodology.

Automation Approaches:

Option 1: Oracle Tax Reporting Cloud If you’re using Oracle’s tax solution, it can calculate tax provisions and generate journal entries automatically based on book income, permanent differences, and temporary differences.

Option 2: External Tax System Integration Many enterprises use specialized tax provision software (OneSource, CorpTax, Longview).

Integration pattern:

- Tax system calculates current and deferred tax expense

- Generates journal entry report

- Integration layer transforms to Oracle journal format

- POST via Journal API with tax-specific attributes and reconciliation keys

Sample Tax Accrual Journal:

json

{

"JournalName": "TAX_PROVISION_JAN26",

"JournalLines": [

{

"AccountCombination": "01-7500-000-0000",

"DebitAmount": 125000,

"Description": "Current tax expense - Federal"

},

{

"AccountCombination": "01-7510-000-0000",

"DebitAmount": 35000,

"Description": "Deferred tax expense"

},

{

"AccountCombination": "01-2400-000-0000",

"CreditAmount": 125000,

"Description": "Current tax payable"

},

{

"AccountCombination": "01-2410-000-0000",

"CreditAmount": 35000,

"Description": "Deferred tax liability"

}

]

}Best Practice: Include tax jurisdiction, entity, and calculation period as Descriptive Flexfield (DFF) attributes on journal lines for detailed reporting and audit support.

Additional Source System Integrations

Task 3 (Inventory Reserves): Integrate with Oracle Inventory Cloud or external warehouse systems to pull slow-moving inventory data, apply reserve policies, and post adjustment journals.

Tasks 8, 15 (General Reserves, Severance): These often require management judgment. Use OIC to orchestrate data gathering from various sources (legal, HR, operations), present to approvers via VBCS app, then auto-post approved entries via API.

Tasks 18, 19 (Investment Income and Unrealized Gains/Losses): Integrate with Treasury Management System or investment accounting platform. Pull investment holdings, calculate fair value adjustments, POST journals with investment-specific attributes.

Category 4: Intercompany and Consolidation Automation

For multi-entity organizations, intercompany transactions and consolidation adjustments are complex but highly automatable.

Task 20: Originating Intercompany Transactions

Oracle Fusion includes native intercompany functionality that can automatically generate balancing entries.

The Solution:

Intercompany Transaction API:

Endpoint: /fscmRestApi/resources/11.13.18.05/intercompanyTransactions

Method: POST

Purpose: Create intercompany transactions that automatically generate sender and receiver entriesHow It Works:

- Business unit A records a transaction (e.g., sale to Business Unit B)

- Oracle’s intercompany rules automatically identify this as intercompany

- System generates matching receivable in A and payable in B

- Balancing lines ensure each legal entity’s books balance

- Transactions flow to both entities’ subledgers and GL

Configuration Keys:

- Define intercompany organizations and relationships

- Set up intercompany accounts (receivables, payables, revenue, expense)

- Configure balancing rules per ledger

- Define default intercompany terms and settlement methods

API Automation:

For complex intercompany scenarios (transfer pricing adjustments, management fees, shared service allocations), you can generate intercompany transactions programmatically:

json

POST /fscmRestApi/resources/11.13.18.05/intercompanyTransactions

{

"TransactionNumber": "IC-2026-001",

"TransactionDate": "2026-01-31",

"ProviderLegalEntity": "US Operations",

"ReceiverLegalEntity": "UK Subsidiary",

"TransactionType": "Management Fee",

"TransactionAmount": 50000,

"Currency": "USD",

"AccountingRules": "Standard IC Revenue/Expense"

}The system automatically creates corresponding GL entries in both entities’ ledgers with proper intercompany account coding.

Task 21: Intercompany Eliminations

Eliminating intercompany balances during consolidation is critical for accurate reporting.

The Solution:

Option 1: Oracle Financial Consolidation and Close Cloud (FCCS)

If you’re licensed for Oracle EPM Cloud, FCCS provides sophisticated elimination capabilities:

- Automatic matching and elimination of intercompany balances

- Elimination journals with full drill-back to source transactions

- Multi-GAAP consolidation support

- Minority interest and equity method calculations

FCCS REST API:

Base URL: https://<instance>.oraclecloud.com/HyperionPlanning/rest/

Endpoints:

- /v3/applications/{app}/jobs (execute consolidation)

- /v3/applications/{app}/data (load elimination journals)Automation Workflow:

- GL balances sync to FCCS via data integration

- FCCS executes consolidation rules (scheduled or API-triggered)

- Elimination journals calculate automatically based on matching IC accounts

- Consolidated results available in FCCS for reporting

- Optionally push elimination journals back to GL via API

Option 2: GL-Based Eliminations

For simpler scenarios without FCCS:

- Use GL Balance Cube API to extract intercompany account balances

- Calculate required elimination entries (receivables vs. payables, revenue vs. expense)

- POST elimination journals via Journal API

- Tag with consolidation attributes for reporting

GL Balance Cube API:

Endpoint: /fscmRestApi/resources/11.13.18.05/glBalances

Method: GET

Purpose: Query account balances for elimination calculationSample Query:

GET /glBalances?q=AccountCombination LIKE '%-2050-%'

AND LedgerName='Consolidation Ledger'

AND PeriodName='Jan-26'This retrieves all intercompany receivable balances, which you can then match against corresponding payables and generate elimination entries.

Tasks 22-23: Equity Method Investments and Consolidation Adjustments

These sophisticated adjustments typically require Oracle FCCS or Hyperion Financial Management (HFM).

Task 22: Equity Method Investment Adjustments

Automation Approach:

- Data Collection: Investee companies provide financial results (via API, FBDI, or manual upload to FCCS)

- Equity Pickup Calculation: FCCS calculates investor’s share of investee income/loss

- Adjustment Posting: System generates equity method adjustment journals

- GL Integration: Journals post to GL via API or FCCS-GL integration

API Pattern:

FCCS loads investee data → Calculates equity adjustment →

Generates journal → Posts to GL via Journal APITask 23: Consolidation Adjustments

Includes fair value adjustments, goodwill impairment, purchase accounting adjustments, and other consolidation entries.

Automation Strategy:

For Standardized Adjustments:

- Configure recurring consolidation journals in FCCS or GL

- Schedule monthly execution

- Auto-post to consolidation ledger

For Complex Adjustments:

- Use FCCS calculation rules and member formulas

- Execute via EPM Automate or FCCS REST API

- Generate adjustment journals with full audit trail

EPM Automate Example:

bash

epmautomate login user@company.com password url

epmautomate runbusinessrule "Consolidation Adjustments" "Jan-26"

epmautomate exportdata "ConsolJournals" "Jan-26" "journals.csv"

epmautomate logoutThen transform exported data and POST to GL via Journal API.

Category 5: Semi-Automated with Workflow

Some entries will always require human judgment, but you can streamline the process significantly.

Task 24: Manual Adjusting Entries

Even in a highly automated environment, ad-hoc adjustments will occur—error corrections, one-time adjustments, reclassifications.

The Semi-Automation Solution:

While you can’t eliminate these entirely, you can optimize the process:

1. Proactive Variance Detection

Use Account Monitor to automatically flag unusual balances:

- Configure threshold rules (amount or percentage variance from budget/prior period)

- System generates alerts when thresholds breach

- Finance team investigates flagged accounts

- If adjustment needed, preparer drafts journal entry

2. Approval Workflow Integration

Leverage Oracle Approval Management Extension (AMX):

- Preparer submits adjustment journal (via UI or API)

- System routes based on amount, account, or other attributes

- Approvers review via email notification or worklist

- Upon approval, workflow automatically calls Journal API with POST action

- Journal posts without manual intervention

3. Template Library

Build a library of common adjustment journal templates:

- Stored in Oracle or external system

- Users select template, enter amounts, submit

- Reduces errors and speeds entry process

API Integration with Approval:

json

POST /fscmRestApi/resources/11.13.18.05/journalBatches

{

"BatchName": "Manual Adjustments - Jan 2026",

"ApprovalStatus": "PENDING",

"JournalEntries": [

{

"JournalName": "RCLASS_JAN26_001",

"PreparedBy": "jsmith@company.com",

"ApprovalRequired": "Y",

"JournalLines": [...]

}

]

}After approval, workflow calls:

json

PATCH /journalBatches/{batchId}

{

"PostingOption": "POST",

"ApprovalStatus": "APPROVED"

}Best Practice: Require journal entry justification and supporting documentation (uploaded as attachments via API). Maintain audit log of all manual adjustments for SOX compliance.

Orchestration: Putting It All Together

Individual task automation is valuable, but the real power comes from orchestrating the entire close process.

Oracle Integration Cloud (OIC) as the Orchestration Engine

OIC is purpose-built for coordinating complex, multi-step processes like the GL close.

Sample Close Orchestration Flow:

Day 1 (Last Day of Period):

- Trigger foreign currency revaluation (ESS job via API)

- Execute recurring journals (prepaid amortization, lease amortization, etc.)

- Wait for completion, check for errors

Day 2:

- Trigger HCM extract for payroll accruals

- Call external systems for tax, equity comp, and other accrual data

- Transform data to journal format

- POST all accrual journals via Journal API

- Execute allocation journals

- Monitor posting status

Day 3:

- Generate intercompany transactions for month-end allocations

- Execute intercompany elimination process

- POST consolidation adjustments

- Trigger Account Monitor to flag variances

Day 4:

- Finance team reviews variance alerts

- Submits manual adjusting entries (workflow approval)

- All approvals completed by EOD

Day 5:

- Final validation checks (all journals posted, no suspense balances)

- Execute FCCS consolidation (if applicable)

- Trigger period close API

- Send notification to stakeholders

- Generate close completion report

OIC Implementation Benefits:

- Visual process designer (no-code/low-code)

- Pre-built adapters for Oracle Cloud apps

- Error handling and retry logic

- Email notifications at each milestone

- Parallel processing for faster execution

- Comprehensive logging and monitoring

Close Task Management

Oracle Account Reconciliation Cloud Service (ARCS) provides close task management:

- Define task lists with dependencies

- Assign owners and due dates

- Track completion status

- Integrate with Smart View for Excel-based tasks

- Dashboard visibility for controllers

API Integration: ARCS REST API allows you to programmatically update task status as automated processes complete:

POST /arcs/api/tasks/{taskId}/complete

{

"completedBy": "System Automation",

"completionTimestamp": "2026-01-31T23:59:59Z",

"notes": "Foreign currency revaluation completed successfully"

}This keeps your close checklist automatically updated without manual status changes.

Key APIs: Quick Reference Guide

Here’s a consolidated reference of the primary APIs you’ll use for close automation:

1. Journal Entry REST API

Primary use: Posting journals from any source

Endpoint: /fscmRestApi/resources/11.13.18.05/journalBatches

Methods: POST (create), GET (query), PATCH (update)

Key Parameters:

- BatchName, LedgerName, AccountingPeriod

- PostingOption: "DO_NOT_POST" | "POST"

- JournalSource, JournalCategory

- Account combinations, amounts, descriptions2. ESS Job Submission API

Primary use: Triggering scheduled processes (revaluation, recurring journals, etc.)

Endpoint: /fscmRestApi/resources/11.13.18.05/erpintegrations

Method: POST

Key Parameters:

- JobDefinitionName (e.g., "GeneralLedgerRevaluation")

- ParameterList (job-specific parameters)3. Period Close API

Primary use: Opening and closing accounting periods

Endpoint: /fscmRestApi/resources/11.13.18.05/ledgerPeriods

Method: PATCH

Key Parameters:

- LedgerName, PeriodName

- PeriodStatus: "OPEN" | "CLOSE" | "PERM_CLOSE"4. GL Balance Cube API

Primary use: Querying account balances for calculation inputs

Endpoint: /fscmRestApi/resources/11.13.18.05/glBalances

Method: GET

Key Parameters:

- LedgerName, PeriodName

- AccountCombination filters

- BalanceType: "ACTUAL" | "BUDGET" | "ENCUMBRANCE"5. Intercompany Transaction API

Primary use: Creating intercompany transactions

Endpoint: /fscmRestApi/resources/11.13.18.05/intercompanyTransactions

Method: POST

Key Parameters:

- ProviderLegalEntity, ReceiverLegalEntity

- TransactionType, Amount, Currency6. File-Based Data Import (FBDI)

Primary use: Bulk journal loads from external systems

Process: Upload to WebCenter Content (UCM)

Template: Pre-built Excel templates for journals

Trigger: ESS import job or automatic processing7. FCCS REST API (if using EPM Cloud)

Primary use: Consolidation and elimination automation

Base: /HyperionPlanning/rest/v3/

Key Endpoints:

- /applications/{app}/jobs (run consolidation)

- /applications/{app}/data (load/extract data)Best Practices for Implementation

1. Start with High-Volume, High-Value Tasks

Don’t try to automate everything at once. Prioritize based on:

- Time spent (which tasks consume the most hours?)

- Error frequency (which tasks have quality issues?)

- Timeliness impact (which tasks are on the critical path?)

Typically, recurring accruals and payroll entries are good starting points.

2. Build Robust Error Handling

Automated processes will fail—APIs timeout, source data is missing, calculations produce unexpected results. Your automation must gracefully handle errors:

- Implement retry logic with exponential backoff

- Log all API calls and responses

- Send alerts when processes fail

- Provide fallback to manual processing

- Never auto-post journals that don’t balance

3. Maintain Audit Trails

Automation doesn’t reduce compliance requirements. Ensure:

- All automated journals include detailed descriptions

- Source system references are captured

- Approval workflows are documented

- Changes to automation logic are version-controlled

- System-generated entries are clearly identified

4. Implement Validation Checkpoints

Before moving to the next close phase, validate:

- All journals balanced and posted successfully

- No suspense account balances

- Expected account balances within reasonable ranges

- Intercompany accounts in balance

- Required approvals obtained

Use Account Monitor and custom validation queries to automatically flag issues.

5. Design for Scalability

Your chart of accounts will expand, you’ll add entities, compliance requirements will change. Build automation that:

- Uses dynamic account derivation (not hard-coded)

- Leverages Oracle’s flexfield and hierarchy structures

- Employs configuration tables (not embedded logic)

- Supports multi-GAAP and multi-currency from the start

6. Document Everything

Create comprehensive documentation:

- Process flow diagrams showing system interactions

- API call sequences with sample payloads

- Business rule documentation (formulas, allocation methods)

- Troubleshooting guides for common issues

- Configuration workbooks (account mappings, rules, etc.)

Future you (and your successors) will thank you.

7. Test Thoroughly

Before deploying to production:

- Test in non-production environment with realistic data volumes

- Validate results against manual calculations

- Perform parallel runs (automated + manual) for at least one full cycle

- Test error scenarios (missing data, invalid accounts, etc.)

- Verify performance with month-end data volumes

- Test rollback procedures for failed automations

8. Monitor and Optimize Continuously

After deployment, continuously improve:

- Track close cycle time reduction

- Monitor API performance and response times

- Analyze failure patterns and address root causes

- Gather user feedback on pain points

- Refine formulas and rules based on actual results

- Update automation as business processes evolve

Security and Access Control Considerations

When implementing API-based automation, security is paramount:

Authentication

Oracle Fusion Cloud APIs support multiple authentication methods:

- OAuth 2.0 (recommended for production integrations)

- Basic Authentication (simpler, but less secure)

- SAML Assertions (for federated identity scenarios)

Always use OAuth 2.0 for production automations. Store credentials securely in Oracle Integration Cloud credential stores or enterprise vaults—never hard-code credentials in scripts.

Authorization

Implement principle of least privilege:

- Create dedicated service accounts for automation (not tied to individuals)

- Grant only required roles (e.g., “General Accounting Manager” for journal posting)

- Use separate accounts for different integration functions

- Regularly review and audit service account permissions

- Disable accounts when integrations are retired

Data Security

Protect sensitive financial data:

- Use TLS/SSL for all API communications (enforced by Oracle Cloud)

- Encrypt data at rest in integration staging areas

- Mask sensitive data in logs (account numbers, amounts in certain contexts)

- Implement IP whitelisting where possible

- Monitor API access logs for suspicious activity

Compliance and Controls

Automation must maintain or enhance internal controls:

Segregation of Duties

- Automation IDs should not have approval rights

- Separate accounts for journal creation vs. posting

- Maintain human oversight on high-risk or high-value entries

- Require approvals for manual adjustments even when posted via API

SOX Compliance Considerations

For public companies, automated close processes must satisfy Sarbanes-Oxley requirements:

- IT General Controls (ITGCs): Version control for automation code, change management processes, access controls

- Process Controls: Automated calculations must be documented and testable, validation checkpoints must prevent/detect errors

- Audit Trail: Complete logging of all automated entries with timestamps and source identification

- Review and Approval: Automated entries should flow through review processes (exception-based for low-risk, full review for high-risk)

Documentation for Auditors

Maintain documentation that demonstrates:

- Process narratives describing each automated close task

- System logic documentation (formulas, allocation rules, etc.)

- Evidence of testing and validation

- Access control matrices

- Change logs showing when automation was modified and by whom

- Exception reports showing when automated processes failed and how issues were resolved

Performance Optimization Strategies

As your automation scales, performance becomes critical:

API Call Optimization

- Batch operations: Use batch journal creation instead of individual journal APIs when posting multiple journals

- Parallel processing: Execute independent tasks simultaneously (e.g., payroll accruals and tax provisions can run in parallel)

- Caching: Cache reference data (account mappings, exchange rates) to reduce API calls

- Pagination: For large data extracts, use pagination parameters to manage memory

- Compression: Enable GZIP compression for large payloads

Timing Strategies

- Off-peak scheduling: Run heavy processes during low-usage periods

- Progressive close: Start automations before period-end (e.g., trigger recurring journals on day 30/31)

- Staggered execution: Sequence tasks to avoid resource contention

- Pre-validation: Validate data quality before starting heavy calculations

Database Performance

- Indexed queries: When querying GL balances, use indexed fields (period, ledger, account)

- Selective retrieval: Request only needed columns and rows

- Summary data: Use balance cube summaries rather than transaction-level queries when possible

Measuring Success: KPIs for Close Automation

Track these metrics to quantify automation benefits:

Time Metrics

- Total close cycle time: Days from period-end to final reporting

- Task-level time: Hours spent per close task (before vs. after automation)

- First-pass accuracy time: Time to complete close without adjustments

- Reporting availability: When can financial results be shared with stakeholders

Quality Metrics

- Error rate: Number of journal corrections required post-close

- Adjustment frequency: How often automated calculations require manual override

- Reconciliation breaks: Outstanding items requiring investigation

- Restatement frequency: How often prior periods require correction

Efficiency Metrics

- FTE hours saved: Staff time freed up for analysis vs. data entry

- Automation rate: Percentage of journal entries posted without human intervention

- Exception rate: Percentage of automated processes requiring manual intervention

- Straight-through processing: Transactions that complete without any manual touch

Example Success Story

A typical enterprise implementing comprehensive close automation might see:

- Close cycle reduced from 10 days to 5 days

- 60-70% reduction in manual journal entries

- 40% reduction in close-related FTE hours

- Error rate reduction of 50% or more

- Finance team time reallocated from transaction processing to variance analysis and business partnership

Common Pitfalls to Avoid

Learn from others’ mistakes:

1. Over-Engineering

Don’t automate for automation’s sake. A simple recurring journal might be better than a complex API integration for a $500 monthly accrual. Focus on materiality and complexity.

2. Ignoring Data Quality

“Garbage in, garbage out” applies to automation. If source system data is unreliable, automation will just produce bad journals faster. Fix data quality first.

3. Insufficient Testing

A journal that posts incorrect amounts is worse than no automation. Test with edge cases, validate formulas with multiple scenarios, and maintain parallel manual calculations during initial deployment.

4. No Rollback Plan

When automation fails at month-end, you need a quick fallback. Maintain documented manual procedures and train staff on backup processes.

5. Brittle Integrations

Hard-coded account numbers, entity names, or business rules make automation fragile. Use configuration tables, value sets, and dynamic derivation logic.

6. Overlooking Change Management

Finance teams need to understand and trust automation. Provide training, demonstrate validation processes, and involve them in design decisions. Don’t just impose a black box.

7. Neglecting Maintenance

Automation isn’t “set and forget.” Plan for ongoing maintenance: updating formulas when policies change, adding new entities, adjusting for organizational restructuring.

The Future: AI and Machine Learning in the Close

While today’s automation focuses on rules-based processes, Oracle and the industry are moving toward intelligent automation:

Predictive Analytics

Machine learning models that predict accrual amounts based on historical patterns, reducing dependency on source system data for estimates.

Anomaly Detection

AI-powered variance analysis that automatically identifies unusual balances or transactions requiring investigation, making Account Monitor even smarter.

Natural Language Processing

Systems that can read email confirmations, PDF invoices, or other unstructured data and generate appropriate journal entries.

Intelligent Document Processing

OCR and AI to extract data from scanned documents, bank statements, or third-party reports and automatically create accounting entries.

Smart Allocations

Machine learning algorithms that optimize allocation methodologies based on consumption patterns rather than static percentages.

Oracle is incorporating these capabilities into Fusion Cloud progressively. Stay informed about new features through Oracle’s quarterly update releases.

Getting Started: Your Automation Roadmap

Ready to begin? Here’s a practical 12-month roadmap:

Months 1-2: Assessment and Planning

- Document current close process (all 26 tasks)

- Identify time spent and pain points per task

- Prioritize automation opportunities (high-value, high-feasibility first)

- Assess technical requirements (APIs, integrations, tools)

- Define success metrics and ROI targets

- Secure stakeholder buy-in and budget

Months 3-4: Foundation Building

- Set up Oracle Integration Cloud (if not already implemented)

- Establish API authentication and service accounts

- Configure security roles and access controls

- Build development and test environments

- Create integration architecture documentation

- Establish change management and testing protocols

Months 5-7: Phase 1 Implementation (Quick Wins)

- Automate recurring journals (Tasks 1, 4, 5, 6, 7, 17)

- Implement foreign currency revaluation automation (Task 25)

- Set up period close API integration (Task 26)

- Configure Account Monitor for variance detection

- Test thoroughly in development environment

- Run parallel with manual processes

Months 8-10: Phase 2 Implementation (Integrations)

- Build integrations for payroll accruals (Tasks 11, 12, 13)

- Automate AR-related adjustments (Tasks 2, 16)

- Implement tax accrual automation (Tasks 9, 10)

- Set up intercompany transaction automation (Task 20)

- Develop workflow for manual adjustments (Task 24)

- Continue parallel processing and validation

Months 11-12: Phase 3 Implementation and Optimization

- Implement remaining accruals and adjustments (Tasks 3, 8, 14, 15, 18, 19)

- Configure intercompany eliminations (Task 21)

- Set up FCCS integrations if applicable (Tasks 22, 23)

- Build orchestration workflows in OIC

- Complete user training and documentation

- Transition to production with monitoring protocols

- Conduct post-implementation review

Beyond Year 1: Continuous Improvement

- Expand automation to additional legal entities

- Automate sub-ledger close tasks (AR, AP, Fixed Assets)

- Implement advanced analytics and dashboards

- Explore AI-powered capabilities

- Share lessons learned across organization

- Mentor other teams on automation best practices

Real-World Implementation Considerations

Multi-National Complexity

For global enterprises:

- Handle multiple GAAPs (US GAAP, IFRS, local statutory)

- Manage multi-currency with various functional currencies

- Accommodate different close calendars (fiscal periods, 4-4-5 vs. calendar months)

- Support multiple languages for journal descriptions and reporting

- Navigate data residency and sovereignty requirements

Oracle Fusion’s multi-ledger architecture supports these scenarios, but your automation must account for these complexities in logic and data routing.

Industry-Specific Requirements

Different industries have unique close challenges:

- Manufacturing: Standard cost updates, inventory reserves, WIP valuations

- Retail: Shrinkage accruals, gift card liability, sales returns reserves

- Software/SaaS: Revenue recognition (ASC 606), deferred revenue schedules, contract modifications

- Financial Services: Loan loss reserves, fair value adjustments, regulatory capital calculations

- Healthcare: Contractual adjustments, bad debt reserves, capitation accruals

Tailor your automation approach to your industry’s specific requirements.

Cloud Migration Scenarios

If you’re migrating from on-premise (E-Business Suite, PeopleSoft, SAP) to Oracle Fusion:

- Plan automation as part of migration—don’t replicate manual processes

- Use migration as opportunity to redesign and streamline close

- Consider temporary hybrid state (some entities in old system, some in Fusion)

- Build integrations that can handle both old and new data sources during transition

- Phase automation deployment aligned with entity migration schedule

Tools and Resources

Oracle Resources

- Oracle Cloud Customer Connect: Community forums, best practice sharing

- Oracle University: Training courses on APIs, integration, GL functionality

- Oracle Support (My Oracle Support): Technical documentation, patches, knowledge articles

- Oracle Technology Network: Developer resources, code samples, tutorials

Documentation Links

- Fusion Applications REST API Documentation: https://docs.oracle.com/en/cloud/saas/financials/

- GL User Guide: Available in Oracle Help Center

- Integration Best Practices: Oracle Integration Cloud documentation

- FCCS REST API Reference: Oracle EPM Cloud documentation

Third-Party Tools

- Postman: API testing and development

- Oracle Integration Cloud Accelerators: Pre-built integration templates

- Monitoring Tools: Splunk, AppDynamics for integration monitoring

- Documentation Platforms: Confluence, SharePoint for maintaining process documentation

Conclusion: Transform Your Close Process

The month-end close doesn’t have to be a stressful scramble. Oracle Fusion Cloud provides the tools and APIs to automate the vast majority of close tasks, freeing your finance team to focus on what they do best—analyzing results, identifying trends, and supporting business decisions.

The journey to close automation isn’t trivial—it requires investment in integration development, change management, and ongoing maintenance. But the benefits are substantial and lasting:

- Faster closes: Reduce close cycle from weeks to days

- Higher quality: Eliminate manual data entry errors

- Better compliance: Strengthen controls and audit trails

- Happier teams: Eliminate tedious, repetitive work

- Strategic finance: Shift time from transaction processing to business partnership

Start with high-value tasks like recurring accruals and payroll integrations. Build your capability incrementally. Measure results and share successes. Before long, your close process will be transformed from a monthly fire drill into a well-oiled machine that runs largely on autopilot.

The future of finance is automated, analytical, and strategic. Oracle Fusion Cloud gives you the platform to get there. Now it’s time to build your roadmap and start automating.

Disclaimer: API endpoints and features are based on Oracle Fusion Cloud as of January 2026. Oracle regularly releases updates that may add new capabilities or modify existing functionality. Always consult the latest Oracle documentation for your specific cloud instance version.